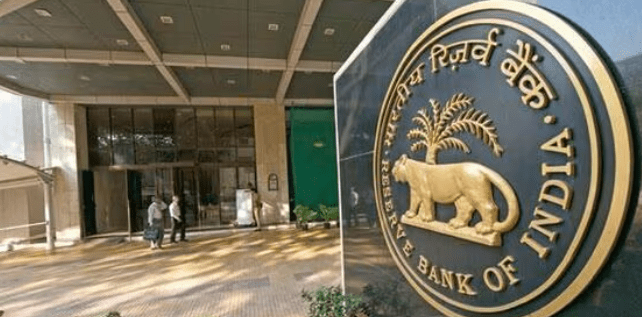

New Delhi – April 6, 2025 — The Reserve Bank of India (RBI) is set to kick off the first monetary policy review of the financial year 2025-26 on Monday, with market expectations tilted toward another 25 basis point rate cut, following a sustained easing in headline inflation.

According to a Reuters poll, a majority of economists anticipate the central bank’s Monetary Policy Committee (MPC) will reduce the repo rate from 6.25% to 6.00%, signaling a continued dovish stance as inflationary pressures ease and growth stabilization becomes a key focus.

This review comes on the heels of February’s landmark move where the RBI cut the repo rate by 25 basis points—the first rate cut in nearly five years—to 6.25%, aiming to support economic momentum while staying vigilant on inflation dynamics.

The RBI conducts six bimonthly MPC meetings each financial year. The upcoming meetings are scheduled for:

- June 4–6

- August 5–7

- September 29–October 1

- December 3–5

- February 4–6

The repo rate, a critical monetary policy tool, dictates the interest at which the RBI lends money to commercial banks, influencing overall credit availability and borrowing costs in the economy.

A further rate cut would provide relief to borrowers and boost consumer spending, especially in interest-sensitive sectors like real estate, automobiles, and infrastructure, even as the central bank keeps an eye on global economic cues and domestic demand.

With retail inflation steadily declining and well within the RBI’s comfort zone, analysts believe there is room for further monetary easing to foster robust growth without compromising price stability.

All eyes are now on RBI Governor Shaktikanta Das and the MPC’s statement, which will not only shape financial markets but also set the tone for India’s monetary policy trajectory in the months ahead.

Leave a comment